By George Jacobson

| Like a vampire who keeps returning to his victim for more blood, the City of Fullerton is back again, this time asking voters to approve on Election Day this November 3rd a permanent one and a quarter cent (1.25 cents) general sales tax measure. The same City Council just a year ago voted to increase water rates by a total of 49% over a 5-year period. Although many residents and local businesses have experienced very serious financial hardship as a result of the pandemic and lockdown, the City Council refused to even consider postponing the scheduled July 1st water rate increase, forcing us to pay what is now to date a 29% water rate increase, and which goes up another 11% next July 1.

DOUG CHAFEE NOW PUSHES THE CORONA VIRUS FRAUD AND FACE MASKS ON THE RESIDENTS ON THE BOARD OF SUPERVISORS AFTER SCREWING FULLERTON OVER FOR YEARS ON THE COUNCIL

Not only that, but by a 4-1 vote (with Council Member Bruce Whitaker voting NO) at its last meeting on July 7, 2020 the City Council instead expressed its desire to squeeze even more money out of residents via a permanent 1.25 cents sales tax increase. Needless to say, a permanent 1.25 cents sales tax can only increase the financial hardship so many in Fullerton have been experiencing, resulting in a higher cost of living for local residents as well as more lost jobs and closed businesses locally.

Here’s what the four City Council members who favor the permanent sales tax don’t want you to know: most, if not all, of the money raised by the sales tax will go toward paying the existing too-high salaries and pension plan benefits for City administrators and other employees, such as those working in the police and fire departments.

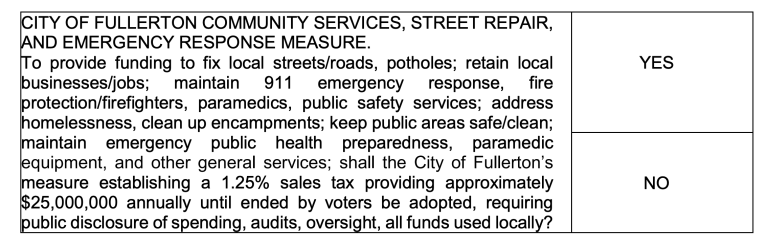

The wording of the sales tax measure tries to mislead you into thinking that most of the money will go towards repairing Fullerton’s roads. The ballot measure’s headline, for example, prominently displays the phrase “STREET REPAIR” in all capital letters, while the paragraph below the headline which purports to describe what the sales tax money will fund begins as follows: “To provide funding to fix local streets/roads, potholes.”

For starters, the sales tax measure is a general sales tax, meaning the City Council can spend the money for any purpose, such as salaries and pension plan contributions for City employees; the Council members are not restricted to spending the tax money on roads. Secondly, the City’s Infrastructure and Natural Resources Advisory Committee (INRAC), determined that the City needs to allocate $24 million/year over a 20-year period to bring Fullerton’s pothole-ridden streets up to a satisfactory condition, and unanimously recommended to the City Council that it adopt a special sales tax whereby all the revenue raised from it would go solely into street repair and other infrastructure needs.

But the City Council flatly turned down this recommendation (again voting 4-1, with Whitaker voting NO), and voted instead to place on the November ballot a general 1.25 cents sales tax measure, which only requires a 50% + 1 “yes” vote to pass. The City Council wants people to believe that Fullerton’s busted up streets will be repaired with the money that a so-called “infrastructure fund” ordinance the Council recently passed will provide.

But the infrastructure ordinance doesn’t come close to accomplishing this. Instead, under a best case scenario — which would be a booming local economy — the revenue from a new sales tax will provide only a fraction of the money needed annually to repair Fullerton’s roads. This means that, even if the general sales tax measure is approved, Fullerton’s streets will continue to get worse and worse, year after year.

So, who wins if the 1.25 cents sales tax measure passes? Well that’s easy to figure out: the City of Fullerton’s employees. Most people will be astounded at the salaries and compensation levels of the City’s employees. Some people I have spoken to believe that a Fullerton policeman, for example, earns $70,000 or maybe $80,000/year in compensation. Here’s the reality. The Transparent California website provides by name the salary, overtime pay, and total compensation level of each City of Fullerton employee.

In visiting this website, one sees that the 51 highest paid City of Fullerton employees work in either the police or the fire department and that each one of them receives over $249,000/year in total compensation. The 15th highest paid employee’s occupation is “Police Officer”– that is to say, he’s just a regular policeman (no additional rank). His total compensation for 2019 was an incredible $313,651!

I can go on and on, but just a quick glance at Transparent California will make you instantly realize that the City’s police and fire employees are way overpaid. To make this fact even more apparent, keep in mind that the FPD’s budget for this year and next is approximately $50 million, which equates to a cost of $345 per resident in Fullerton for police services. If Fullerton contracted with the Orange County Sheriff’s Department and paid $221/resident (the average cost for OCSD contracted cities), the city of Fullerton would save $18,006,051 per year. If Fullerton could get the same deal as Yorba Linda, which pays the Sheriff’s Department only $180 per resident, it would save nearly $24 million/year, which just so happens to be the exact amount that INRAC said Fullerton needs to spend each year to repair its streets and roads.

In addition, while all too many people in Fullerton during this pandemic have seen their income decline or even disappear, the Fullerton City Council has approved a salary increase for those working in the Police Department. In short, the entire point of the permanent 1.25 cents sales tax measure is to maintain the existing too-high salaries and pension plan benefits for City employees. But, of course, the City Council doesn’t dare tell people the truth, because then few people would vote in favor of the sales tax measure.

https://youtu.be/KVi2TR9yl4s

I must mention one outright lie the sales tax ballot measure contains, which is this wording: “retain local businesses/jobs.” Common sense tells you that a higher sales tax will drive some businesses out of business, as a certain number of customers will shop instead in a nearby city, such as Brea, Anaheim or Buena Park, which have no additional local sales tax.

This doing one’s shopping elsewhere will especially be the case with high dollar value items, such as kitchen appliances and furniture. Scientific studies confirm that a local sales tax is, indeed, harmful to the local economy. For example, a 2012 study published in the National Tax Journal, titled “The Effect of Sales Taxes on Employment,” found the following: “Sales tax changes have a detrimental effect on employment, payroll, and hiring.”

Niccolo Machiavelli’s advice to a ruler was, “Tell people what they want to hear.” This can be the only explanation behind the City’s placing on the ballot the obviously wrong “retain local businesses/job” wording, for if they placed on the ballot the scientifically-determined truthful wording — “lose local businesses/jobs” — people would vote against this permanent sales tax measure.

Economics 101 is that you do NOT raise taxes during a depression or recession. Doing so only increases the financial hardship and suffering of people. But, the plight of Fullerton’s residents and local businesses seems to be of no concern whatsoever to four members of the Fullerton City Council. Which is why this coming November, 3, 2020 it’s time to provide a big surprise to the vampire.

#1 by Frank Logic on July 28, 2020 - 10:21 am

I see this new video of a grouonof doctors in a staged press conference setting , talking about and promoting the drug hydroxychloroquine, i heard a broadcast or 2 of you mentioning the reason as to why they are suggesting this drug and it sounded compelling. However im trying to reiterate it butnlack the knowledge, but im sure there is a reason they are pushing this whole drug through a doctors press conference and pushing folks to share before they remove and sensor it ,playing the card in favor of the woke folks realizing they sensor and remove powerful info. it just seems fishy and staged ….is there anyway i can get content or a video reference to go look up , or something i really am interesting in sharing this info with my clise friends and family so they dont get duped. Thanks for all you do brother god bless.